Summary: A look at the love, launch and lapse phenomenon encountered by many start-ups, what underlies the lapse, and how to mitigate it happening to your firm.

Over the past 20 years I’ve followed the successes and failures of firms in the data storage and data management arena. I’ve noticed a phenomenon that impacts those who sell enterprise software and systems based on new, or potentially disruptive, technology. In today’s market such technology would include systems based on solid state disks (SSD) as well as some cloud enablers, virtualization/VDI solutions and Big Data solutions

The phenomenon is the love, launch, and lapse phases many start-ups experience. In other words, most tech firms experience a honeymoon period that eventually ends. Here’s what happens:

Love at First Sight: The executives and board members are working their Rolodex to sign up beta customers and these initial customers love you. Additionally, analysts and journalists are calling you and you haven’t even come out of stealth mode. If you are out of stealth you may even have been recognized with a “most promising” or “company to watch” award.

Launch Like a Rocket: You hire a PR agency and announce your venture funding and your new product. You get lots of press coverage, especially in the storage media that you read every day. Additionally, your sales team has a bunch of prospective customers. You may even have some noteworthy customers.

Under these circumstances the typical CEO adds salespeople and minimizes the budget for paid promotions like advertising. After all, the prospects in the pipeline were relatively easy to get and PR is driving the funnel. Given everyone’s enthusiasm the plan presented to the board will likely be high on the revenue forecast and low on marketing expenses.

Lamentable Lapse: However, as the quarters pass the vast majority of “hot” prospects turn cold and the press coverage is no longer generating many leads. Other firms now dominate the editorials. The resellers are signed-up, but not selling. There’s little discretionary budget available for promotional campaigns and the few that are tried don’t produce enough results. The marketers are sent on the fruitless quest to find the “magic well” — a single source for high volume, low-cost, purchase-ready leads. The blame game is heating up so office politics between sales and marketing are becoming a drain on productivity. The PR agency is fired. The VP of sales is replaced. The VP of marketing is replaced. Eventually, the CEO is replaced.

What happened?

The analysts and press are always interested in new technology, new products, and new firms. It’s their job to know what is going on in the market. They trade in that knowledge as well as sell their own services to storage vendors. Almost every technology start-up can get their “15 minutes of fame.”

PR agencies know that, so a few storage specialist PR-only firms have built their entire business on the “launch and leverage” model. I prefer to call it the “launch and lapse” model. It’s a great model for PR agencies. News about new technology, products and VC funded companies is in demand so the agency can usually show great initial results to the client (and to the client’s competitors — the PR agency’s new prospects). However, when the launch is done the “heavy lifting” starts. At that point, the PR agency executive that sold the service turns the start-up over to a less influential account manager and moves on to new business (often the client’s competitors.)

Most new publicity (PR or advertising) will release a pent-up demand for information about what’s being promoted. It’s that pent-up demand for certain information that results in an initial surge of leads, followed by diminishing returns. These diminishing returns are easiest to see with some online adverts. The early placements generate more results than later placements (I know, it’s the opposite of print and what the advertising sales rep tells you.) The initial demand is satisfied so when the publication’s audience is not growing at a sufficient rate, the volume of sales leads falls for the same advert. It’s normal!

Of the leads that come in, it’s not uncommon for a technology firm to see a high number of “false positives.” These look like good leads, but don’t close quickly (or at all) so the close rate is very low. False positives result when the hype surrounding a new technology piques peoples’ curiosity. They want to learn about it so they end up downloading the white papers and otherwise flagging themselves as a lead. However, if the new technology has multiple applications (e.g. SSD in consumer and enterprise applications), is complex (e.g. integrates into larger systems and requires buy-in from many people) or is expensive (e.g. beyond the budget authority of the purchase champion) you should expect a long and difficult sales process that can take months, or even years, of nurturing and selling.

What about the happy customers? Beta customers are not the same as real customers, even if they are big names. Many large enterprises are willing to try new technology. The real test is whether they deploy it widely as a result. Additionally, the start-up probably sold the beta product at a big discount (or gave it away) and the tech support people are the best engineers who’ll drop everything to deal with an issue. Lastly, as good as the executives and board may be at at leveraging their executive-level contacts, that sales model is not scalable or repeatable by ordinary salespeople.

Unfortunately, big OEM deals can also result in an eventual lapse. The big OEMs – HP, Dell, IBM, etc. – have annual design cycles for their server and storage products so the components suppliers chosen this year may not be the same as those chosen next year. Big suppliers like Seagate and Western Digital can keep up with the design cycles, but a start-up is typically so overwhelmed with the initial design-in business that they fail to secure the second and subsequent supply contracts. An established vendor that loses a design-in contract will turn to other customers (often through an established distribution channel), but a start-up often goes out of business (or gets acquired at a low valuation). Others, like STEC, may just lose half their stock value.

Unfortunately, big OEM deals can also result in an eventual lapse. The big OEMs – HP, Dell, IBM, etc. – have annual design cycles for their server and storage products so the components suppliers chosen this year may not be the same as those chosen next year. Big suppliers like Seagate and Western Digital can keep up with the design cycles, but a start-up is typically so overwhelmed with the initial design-in business that they fail to secure the second and subsequent supply contracts. An established vendor that loses a design-in contract will turn to other customers (often through an established distribution channel), but a start-up often goes out of business (or gets acquired at a low valuation). Others, like STEC, may just lose half their stock value.

In fact, it’s often the lucky start-ups that are overwhelmed with fulfilling the demand of a large customer. They are generating revenue and have proven the end-user demand for their innovation. Others sign promising deals with big OEMs (with all kinds of hooks and exclusivity requirements), but the OEM does not sell nearly as many as forecast.

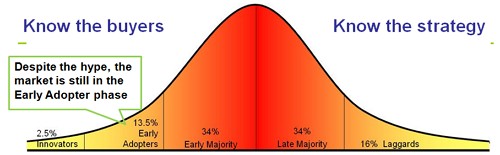

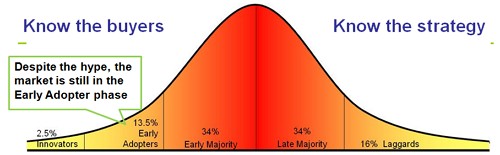

All of these factors assume that a market exists and therefore the sales issues can be overcome. That’s not a given, but I can accept that it is for most data storage products. There is a growing need for capacity, speed, protection and management of data. However, a market is made up of different types of buyers who require different things.

SSD Market 2011

A new market segment is made up of “Innovators.” These buyers are technology enthusiasts willing to try new ideas at some risk. They like to test new things and don’t need complete solutions. They just need access to new technology. These Innovators may buy the product based on its technological capabilities. However, the larger number of “Early Adopters” have different needs.

Early Adopters are looking for a breakthrough advantage in their business and require complete solutions. A solution is not a just box full of Flash or some other technology. Solutions include expertise in the customer’s environment. Therefore, successful firms sell an augmented product that includes more than their raw technology. For example, Texas Memory Systems, a 30+ year old solid state disk supplier, speaks fluent Oracle. They employ an “Oracle Guru” who works with the DBAs that initially identifies the performance problem that’s ultimately solved by the product being sold.

The challenge for the start-up in new market segments is to solve both a technical problem and a business problem. Solving the technical problem can generate a few sales to the Innovators. However, a business problem must be solved to sell to the Early Adopters and many technology start-ups don’t invest enough to market and sell in this environment.

What Really Happened?

The lapse is a result of the executives doing something reasonable. They believed their own eyes and planned accordingly. Unfortunately, they did not recognize that they could be in a honeymoon period so the number of prospects in the pipeline was significantly smaller than it needed to be and the infrastructure to generate leads was lagging.

The initial good news made everyone optimistic when they would have been better served by hoping for the best, but planning for the worst.

Hoping for the best, but planning for the worst

Technology start-ups often establish just one of the 4-Ps necessary for sales success. They establish the product, but do not establish a working promotion, pricing, or channel (place-of-sale) model. In a nutshell, they do not build a working sales and marketing system before the clock runs out. A working system allows you to execute a process and get reasonably predictable results.

Sales leads are at the core of the system. Since people can’t buy what they don’t know about, promotions are used to create market awareness, build brand recognition, and generate sales leads. These promotion-driven sales leads not only have the potential to drive revenue, they are also critical to optimizing your overall marketing. They are the equivalent of an early warning system.

For example, if you know what you are doing and what to expect (as my firm, Marketingsage, does) and it turns out to be difficult and excessively expensive to generate sales leads then you’ve learned something. Your message is not working for the audience you promote to. If the audience includes your customer prospects and your message talks about your product, you may have a positioning issue or need to rethink the offering.

On the other hand, if you are generating leads at a reasonable price it’s fair to conclude that your message is resonating. Therefore if there is a sales issue, you save time and considerable money by investigating product, pricing or channel expectations first. Without a reliable flow of leads, you have to ask if you’ve generated enough awareness for your offering. The only way to answer that question quickly is run many simultaneous promotions. That’s expensive and a big risk for resource- and time-constrained start-ups.

There’s another benefit to building a lead generation system. If you do enough lead generation you’ll end up with a fairly reliable cost-per-lead (CPL) number and a close rate percentage. Those numbers allow you to plan and budget effectively.

For example, if you pay the industry average of $60 CPL and close 0.5% of leads, you can calculate that you need 200 leads per sale and those leads will cost $12,000. If this year’s revenue target is $10-million and the average customer generates $100,000, you need 100 customers. The 20,000 leads you need for 100 customers will cost $1.2-million in promotions. If the sales lead time is 6 months you need all your leads by the end of June. That means the promotions had to ramp up last year. Of course, that’s a little simplistic, but hopefully you get the idea.

Your numbers may be different, but the scenario presented is typical enough. The good news is: When you have data, you can start to drive down the CPL and drive up the close rate to optimize your system. Additionally, happy customers can be expected to purchase more. Therefore, their 3- or 5-year value is often substantially higher than the value of the first year’s sales and the cost of incremental sales is far lower.

There are many ways to generate sales leads (see The Most Effective Sales Lead Generation Methods for Storage and Enterprise Software) – too many to discuss here. However, the difference between a mature lead generation system and ad hoc promotion is typically the inclusion of online advertising.

There are many ways to generate sales leads (see The Most Effective Sales Lead Generation Methods for Storage and Enterprise Software) – too many to discuss here. However, the difference between a mature lead generation system and ad hoc promotion is typically the inclusion of online advertising.

Done properly, online advertising is effective, cost-effective and relatively predictable. Unlike other promotional methods you can control the placement, timing, message and call-to-action. This control allows you to adjust and optimize in a relatively short period of time. Additionally, it’s scalable!

Bogging, tweeting, cold calling, trade shows, seminars, etc. all require human resources. Consequently, they can be considerably more expensive for the results achieved than just spending a few well placed dollars on advertising.

Bottom Line for CEO’s, VPs and VCs

Recognize that your firm is likely to experience a honeymoon period. Set realistic expectations so you have a chance of success and can justify the necessary up-front investment in lead generating promotions, not just product development.

Realize that the sales cycle for enterprise storage products can be very long. Think 6+ months for today’s enterprise SSD systems and other new technologies in emerging markets. Add months to get promotional campaigns producing. Add quarters if you need to staff-up, build infrastructure as well as get the campaigns producing.

From day-one, build a scalable lead generation and lead nurturing system so you know that you can generate more/less leads as required from various sources.

About the Author

David X. Lamont is an accomplished marketer of IT products and a partner at Marketingsage, a PR and lead generation firm that specializes in marketing data storage, data management, and enterprise software products. He can be reached by email at blog [at] marketingsage.net. Fellow marketers and IT professionals are invited to join his network on LinkedIn and to subscribe to this blog (see sidebar).